Contents:

It provides a platform for sellers and buyers to interact and trade at a price determined by market forces. Once you are able to seamlessly plot fib retracements, they can be used just like an indicator on all your trades. To avoid having too many lines and indicators, you can opt to stick to a specific time frame like a 60-minute chart. The ideal fib ranges will be plotting a high to low and low to high points using the weekly charts back to 2009. If there range is too wide between fib points, then a 15-minute or 5-minute high to low and low to high can be used. Fibonacci retracement levels are widely used in technical analysis for financial market trading.

Each line indicates a time in which major price movement can be expected. Fibonacci time zones are a time-based indicator used by traders to identify where highs and lows may potentially develop in the future. Investopedia Academy’sTechnical Analysis coursecovers these indicators as well as how to transform patterns into actionable trading plans. The basis of the «golden» Fibonacci ratio of 61.8% comes from dividing a number in the Fibonacci series by the number that follows it.

Fibonacci numbers are also closely related to Lucas numbers, which obey the same recurrence relation and with the Fibonacci numbers form a complementary pair of Lucas sequences. They are named after the Italian mathematician Leonardo of Pisa, later known as Fibonacci, who introduced the sequence to Western European mathematics in his 1202 book Liber Abaci. The Fibonacci sequence is a recursive series of numbers where each value is determined by the two values immediately before it. For this reason, the Fibonacci numbers frequently appear in problems relating to population growth. When used in visual arts, they are also aesthetically pleasing, although their significance tends to be highly exaggerated in popular culture. The limits of the squares of successive Fibonacci numbers create a spiral known as the Fibonacci spiral.

The https://traderoom.info/ typically goes 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on. As an illustration, a stock begins at $10 and soars to $15 before slipping back to $12.5. If the price starts rallying and goes to $20, that is an extension. You might also want to set a stop-loss at the 61.8% level, as a return below that level could indicate that the rally has failed. Fibonacci retracements can be used on a variety of timeframes.

Definition & Erklärung des Fibonacci Retracements

We provide our members with courses of all different trading levels and topics. We don’t care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good. We know that you’ll walk away from a stronger, more confident, and street-wise trader. What we really care about is helping you, and seeing you succeed as a trader.

- Unlike ‘reversal,’ which are more permanent price drops, a pullback remains only for a short while.

- Learn how to trade forex in a fun and easy-to-understand format.

- This can vary significantly depending on each trader’s setup, strategy, and trading style.

- It works because it allows traders to identify and place trades within powerful, long-term price trends by determining when an asset’s price is likely to switch course.

- The ratios, integers, sequences, and formulas derived from the Fibonacci sequence are only the product of a mathematical process.

However, it can be uncomfortable for fibonacci retracement definition who want to understand the rationale behind a strategy. Fibonacci retracements can be used to place entry orders, determine stop-loss levels, or set price targets. Since the bounce occurred at a Fibonacci level during an uptrend, the trader decides to buy. The trader might set a stop loss at the 61.8% level, as a return below that level could indicate that the rally has failed. When these indicators are applied to a chart, the user chooses two points. Once those two points are chosen, the lines are drawn at percentages of that move.

Creating Fibonacci Extensions

The tool can also be used across various asset classes, including foreign exchange, stocks, commodities, cryptocurrencies, futures, options, and index funds. It works because it allows traders to identify and place trades within powerful, long-term price trends by determining when an asset’s price is likely to switch course. Furthermore, a Fibonacci retracement strategy can only point to possible corrections, reversals, and countertrend bounces. This system struggles to confirm any other indicators and doesn’t provide easily identifiable strong or weak signals. Despite the popularity of Fibonacci retracements, the tools have some conceptual and technical disadvantages that traders should be aware of when using them.

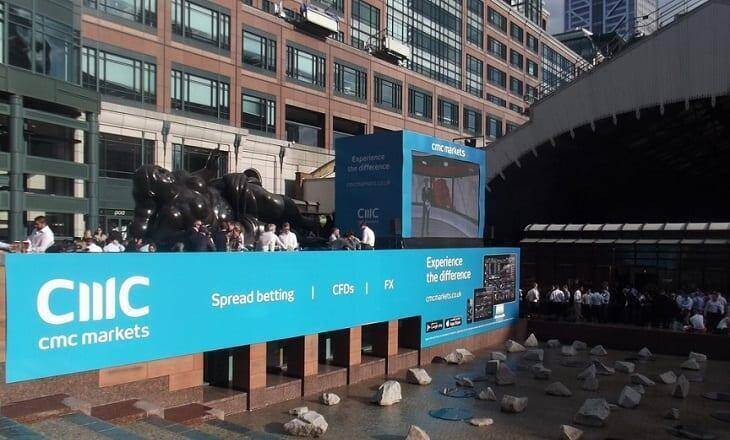

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. The most popular retracement percentages to use are 23.6%, 38.2%, 50%, 61.8%, and 100%. Overall, the Fibonacci retracement strategy prepares traders for the upcoming fluctuations in the market and allows them to trade safely in unpredictable market scenarios.

Fibonacci retracement definition

Thanks to books like Dan Brown’s The Da Vinci Code, the golden ratio has been elevated to almost mystical levels in popular culture. However, some mathematicians have stated that the importance of this ratio is wildly exaggerated. In this sequence, each number is simply the sum of the two preceding numbers (1, 1, 2, 3, 5, 8, 13, etc.). Although Fibonacci introduced these numbers to the Western world, they were actually discovered by Indian mathematicians hundreds of years earlier. The poet Pingala used them to count the syllables of Sanskrit poetry around 200 B.C., and the method for calculating them was formulated by the Indian mathematician Virahanka around 800 years later.

Harmonic Patterns in the Currency Markets – Investopedia

Harmonic Patterns in the Currency Markets.

Posted: Sat, 25 Mar 2017 20:13:28 GMT [source]

The Fib retracement tool is derived from a string of numbers identified by mathematician Leonardo Fibonacci in the 13th century. Also, we provide you with free options courses that teach you how to implement our trades as well. Our watch lists and alert signals are great for your trading education and learning experience.

Fibonacci retracement

We want you to see what we see and begin to spot trade setups yourself. If you do not agree with any term of provision of our Terms and Conditions, you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions. This is under the unrealistic assumption that the ancestors at each level are otherwise unrelated. A one-dimensional optimization method, called the Fibonacci search technique, uses Fibonacci numbers. Fibonacci numbers arise in the analysis of the Fibonacci heap data structure.

In his book Liber Abaci, he described the Hindu-Arabic numeral system represented by the numbers 0 through 9. He called this the «Modus Indorum,» or the method of the Indians. Euler’s number is a mathematical constant with many applications in science and finance, usually denoted by the lowercase letter e. Many things in nature have dimensional properties that adhere to the golden ratio of 1.618. The inverse of the golden ratio (1.618) is 0.618, which is also used extensively in Fibonacci trading.

As a result, employing this indicator alongside other technical analysis devices is highly recommended. Generally, the more confirming factors are present, the more robust and reliable a trade signal is likely to be. Fibonacci Retracements are displayed by first drawing a trend line between two extreme points. A series of six horizontal lines are drawn intersecting the trend line at the Fibonacci levels of 0.0%, 23.6%, 38.2%, 50%, 61.8%, and 100%. Fibonacci clusters are areas of potential support and resistance based on multiple Fibonacci retracements or extensions converging on one price. Fibonacci retracements are particularly popular among speculative derivatives traders, who look to exploit small margins.

To calculate Fibonacci retracement levels, technical analysts draw six lines on an asset’s price chart. The first three are drawn at the highest point (100%), the lowest point (0%) and the average (50%). The remaining three lines are drawn at 61.8%, 38.2% and 23.6%, which are significant percentages in the Fibonacci sequence.

For unknown reasons, these Fibonacci ratios seem to play a role in the stock market, just as they do in nature. Technical traders attempt to use them to determine critical points where an asset’s price momentum is likely to reverse. The best brokers for day traders can further aid investors trying to predict stock prices via Fibonacci retracements. In technical analysis, Fibonacci retracement levels indicate key areas where a stock may reverse or stall. Usually, these will occur between a high point and a low point for a security, designed to predict the future direction of its price movement. Fibonacci retracement levels are static, unlike moving averages.

BearishBearish market refers to an opinion where the stock market is likely to go down or correct shortly. It is predicted in consideration of events that are happening or are bound to happen which would drag down the prices of the stocks in the market. For an investor, price target reflects the price at which he will be willing to buy or sell the stock at a particular period of time or mark an exit from their current position. Dow TheoryThe Dow theory is founded on ideas derived from Charles H. Dow’s editorials. It fundamentally states that a significant shift between bear and bull sentiment in a stock market will occur when multiple indices confirm it.

The surge to the 62% retracement was quite strong, but resistance suddenly appeared with a reversal confirmation coming from MACD . The red candlestick and gap down affirmed resistance near the 62% retracement. There was a two-day bounce back above 44.5, but this bounce quickly failed as MACD moved below its signal line . Chart 4 shows Petsmart with a moderate 38% retracement and other signals coming together.

Extension levels are also possible areas where the price may reverse. Fibonacci retracements trace their roots back to Fibonacci numbers where were discovered centuries ago and developed into a technical analysis tool. The realization that COVID-19 would spread throughout the United States created an instant bear market beginning in February and hit a bottom in March. Prices dropped from approximately 3,400 to 2,200 and then rebounded to the 38.2% retracement level. In fact, it will often retrace to a Fibonacci retracement level, which can indicate an entry or exit point in the direction of the original trend.

Field daisies most often have petals in counts of Fibonacci numbers. Braun discovered that the parastichies of plants were frequently expressed as fractions involving Fibonacci numbers. Actually, financial markets have the very same mathematical base as these natural phenomena. Below we will examine some ways in which the golden ratio can be applied to finance, and we’ll show some charts as proof. Here, we take a look at some technical analysis tools that have been developed to take advantage of the pattern. Fibonacci extensions are a tool that traders can use to establish profit targets or estimate how far a price may travel after a pullback is finished.